In finance, you often come across different terms that mean the same thing, or almost the same thing. Such is the case with the cash coverage ratio (CCR), which is the same as the cash ratio. It is also similar to cash debt coverage ratio, cash flow to debt ratio, and cash flow coverage ratio.

Cash Equivalents

The cash flow coverage ratio is a liquidity ratio that measures a company’s ability to pay off its obligations with its operating cash flows. In other words, this calculation shows how easily a firm’s cash flow from operations can pay off its debt or current expenses. The current cash users of accounting information internal external examples debt coverage ratio can be determined either by dividing a company’s operating cash flow by its current liabilities or by averaging the current liabilities figure over a period of time. Whichever calculation yields a higher number reflects the better liquidity position of the company.

How to Calculate the Cash Coverage Ratio: A Step-by-Step Example

There are more current liabilities than cash and cash equivalents when a company’s cash ratio is less than one. Net income, interest expenditure, debt outstanding, company’s cash balance, and total assets are just a few examples of financial statement components to scrutinize. To determine a firm’s financial health, look at liquidity and solvency ratios, which examine a company’s capacity to pay short-term debt and convert assets into cash. The current cash debt coverage ratio should be used when analyzing a company’s ability to repay its current liabilities in the short-term (usually, within 12 months). The current cash debt coverage ratio is a quantitative value that gauges the liquidity of a company.

Optimizing a Company’s Cash Coverage Ratio

Ultimately, if the cash flow coverage ratio is high, the company is likely a good investment, whether return is seen from dividend payments or earnings growth. Cash coverage ratio is a financial ratio that measures the number of dollars of operating cash available to pay each dollar of interest expenses and other fixed charges. The cash coverage ratio is a simple comparison between cash and equivalents on hand to the interest expense. The cash coverage ratio, also known as the current ratio, is calculated by dividing total current assets by total current liabilities.

- Business owners should aim for a ratio of 2 or above, which means that interest expenses can be covered two times over.

- The Cash Coverage Ratio is a financial metric that evaluates a company’s ability to cover its interest expenses using its EBITDA.

- If you’re a sole proprietor or a very small business with no debt on the books, other accounting ratios are much more useful, such as current ratio or quick ratio.

To calculate this ratio, you take the company’s operating income before tax and divide it by its nonoperating expenses, including interest payments and amortization costs over the same period. It requires stakeholders to divide a company’s earnings before interest and taxes after adding non-cash expenses by its interest expense. When obtaining finance, most lenders consider the coverage ratios before deciding. As mentioned, several coverage ratios may be of interest to these parties.

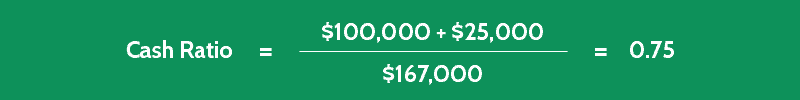

Calculate the current cash debt coverage ratio by extracting the net cash flow from operating activities from the cash flow statement and dividing it by the company’s average liabilities. Coverage ratios allow stakeholders to measure a company’s ability to pay financial obligations. Several coverage ratios look at different aspects of a company’s resources and obligations. The cash ratio is calculated by dividing cash by current liabilities. The cash portion of the calculation also includes cash equivalents such as marketable securities.

Financial analysis is incomplete without understanding how companies handle their debt obligations. This ratio helps investors and analysts assess a company’s financial health, solvency, and its capacity to honor debt payments. Cash coverage ratio and times interest earned are two important metrics used to measure a company’s financial health. Both ratios provide insight into a company’s ability to pay its debts in the short term. A company’s cash ratio is calculated by dividing its cash and cash equivalents by its short-term liabilities. A company can strive to improve its cash ratio by having more cash on hand in case of short-term liquidation or demand for payments.

It is frequently used by lending institutions to determine whether a business is financially able to take on more debt. A ratio of 1 means that the company has the same amount of cash and equivalents as it has current debt. In other words, in order to pay off its current debt, the company would have to use all of its cash and equivalents. A ratio above 1 means that all the current liabilities can be paid with cash and equivalents. A ratio below 1 means that the company needs more than just its cash reserves to pay off its current debt. In this ratio, the denominator includes all debt, not just current liabilities.