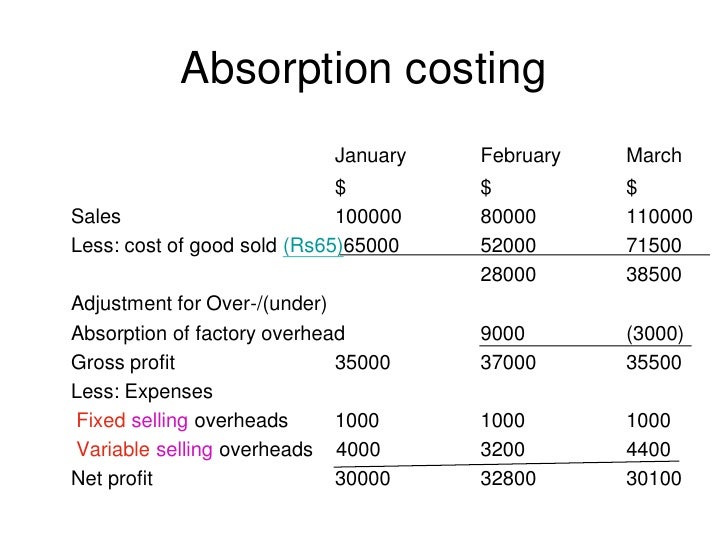

If expenses exceed your income, this is considered a “loss.” Airbnb hosts typically can’t take a loss on passive income. In certain situations, a loss can be deducted from future rental income. Putting them in the right categories for each property is how you will save time when filling out tax forms.

How much does accounting software cost?

Check if your potential accounting software integrates with a PMS like Hostfully or is supported by Zapier. Many free options are available, but more comprehensive accounting software can cost as much as $1000 per month. The cost of accounting software can vary quite a bit, and there are many different choices available at multiple price points, so there’s something out there for everyone. Here are a few simple steps for hosts wondering how to get started with https://www.bookstime.com/articles/church-chart-of-accounts and accounting.

Wave: Best Free Software to Track Income & Expenses

- Despite these shortcomings, FreshBooks remains a top choice for hosts looking for a user-friendly accounting solution.

- Accounting software comes to the rescue, significantly reducing the time and effort required for bookkeeping tasks.

- Embarking on a journey of DIY bookkeeping offers Airbnb hosts & Investors a range of advantages, revolutionizing the way they manage their financial landscape.

- It’s hard to argue with the price of “free.” In addition to its other advantages, that’s one major benefit that Wave Accounting brings to the table.

- Before making a final decision, it’s essential to conduct thorough research and perhaps consult with a tax professional to understand how each method would impact your specific situation.

Airbnb will send Form 1099-K to hosts with more than 200 reservations or earn over $20,000 in a calendar year. You must pay taxes on your Airbnb income if you rent your main residence (house airbnb bookkeeping or apartment) for more than 14 days during the year. This includes any money you receive for using the investment property and related services, like cleaning fees and maintenance.

Best Airbnb Accounting Software Tools for 2024

Subscription fees are comparatively low, even for paid plans and features. That said, this is one cross-industry accounting solution that doesn’t yet have any rental-specific integrations (so you won’t benefit from industry tools like Bnbtally). One of the most common mistakes new rental property owners make is to go for a cheaper option to save a few dollars a month. Tools that don’t fit your needs can hamper your ability to grow and achieve your goals. That’s because free or cheap accounting software has limitations that will show as you grow past a certain property count. But you’ll eventually need to switch to a more advanced option and that brings the potential for data loss in the process of migration.

By recognizing the distinct characteristics of Airbnb bookkeeping, you can efficiently manage your finances, make informed decisions, and foster the growth of your home-based hospitality business. The IRS considers a property a personal residence if you use it for more than 14 days in the tax year, or more than 10% of the total days you rent the property to guests. If you’re doing maintenance or upgrades on the property, that time doesn’t count toward your personal use, but you still need to include it on your log. There are other exceptions, as well as unexpected tax implications that can arise. We strongly recommend speaking with a CPA who is experienced in filing taxes for short-term rental owners and can assist you with a strategy to get the greatest tax benefits out of your rental.

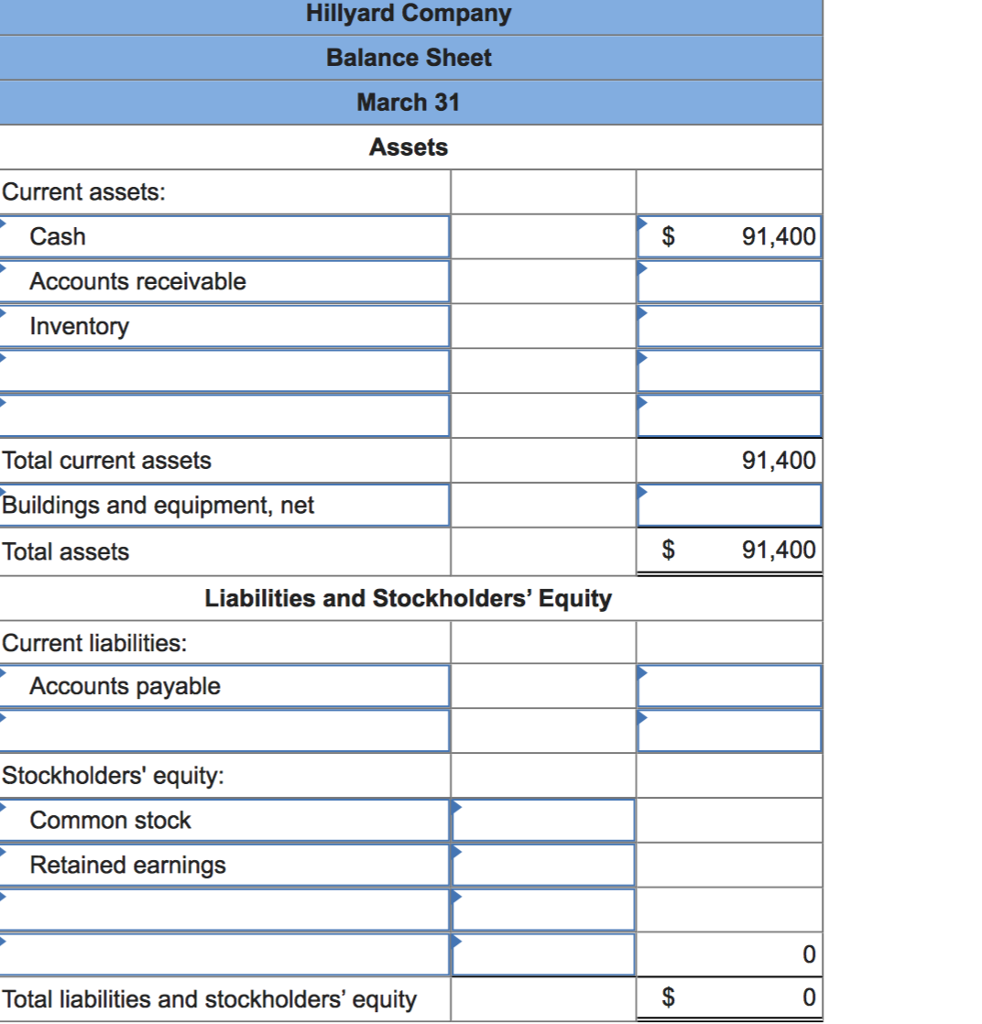

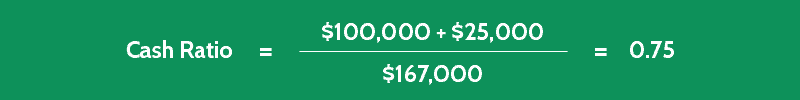

How to Calculate Cash On Cash Return for Rental Properties Efficiently

It involves recording all income received from reservations, including base rental fees, cleaning fees, and any additional services provided to guests. Additionally, it’s crucial to track Airbnb’s payouts to your bank account, ensuring that all revenue is accounted for. What sets Airbnb bookkeeping apart is its resemblance to both the hotel and accommodations industry and its home-based nature. This is exactly the situation where accounting software for Airbnb hosts in specific becomes invaluable. These tech-based tools are designed to handle everything from tracking income and expenses for multiple properties to integrating with Airbnb property management systems and automating tax calculations. Hosts hoping to select the best accounting software for Airbnb have come to the right place.

- You may still be required to collect occupancy taxes in some areas manually.

- Invoice status reports let vacation rental hosts know which guests have viewed and paid invoices.

- These include invoice status reports, a payment log, and a communication platform that allows you to communicate with guests.

- Hosts hoping to select the best accounting software for Airbnb have come to the right place.

- The amazing thing about Instabooks is that it’s totally free accounting software for United States small businesses.

- Wave Accounting markets itself as “accounting software that works as hard as you do.” It’s easy, free, and intuitive software, and users can get started in seconds.

Understanding the difference between home improvements and repairs is crucial for proper tax reporting. Home improvements refer to significant upgrades that add value to your property, such as remodeling a bathroom or renovating the kitchen. These improvements are typically capitalized and depreciated over time.

- If you’re ready to outsource the back office of your rental property business, contact us to schedule a consultation.

- I have summarised for you the key metrics that you should be tracking and given you some good ideas to get started.

- Proper Airbnb bookkeeping can make a difference in your bottom line and help you operate more efficiently.

- However, business expenses relating entirely towards your business will remain fully deductible, such as advertising, office supplies, etc.

- In addition, maybe you don’t have the budget to hire tech support to help with onboarding or to solve any technical problems that occur.

- Check if your potential accounting software integrates with a PMS like Hostfully or is supported by Zapier.

Offering a range of accounting features for free, Wave is the best budget-friendly option available. From tracking income and expenses to managing tax liabilities, Wave offers a comprehensive suite of features that would usually come with a hefty price tag. In the end, you should think in terms of streamlining certain parts of your workflow, and automating manual or repetitive tasks by leveraging integrations with a PMP like Hostfully. It’s got all the features you need to grow your vacation rental business, reach more customers, and create great guest experiences. Use a single software to manage listings on Airbnb, Vrbo, or other OTAs, see and close bookings faster, and upsell your guests.